About Pvm Accounting

Table of ContentsThe 5-Second Trick For Pvm AccountingWhat Does Pvm Accounting Mean?Little Known Questions About Pvm Accounting.What Does Pvm Accounting Mean?The Basic Principles Of Pvm Accounting The Ultimate Guide To Pvm AccountingThe 7-Minute Rule for Pvm Accounting

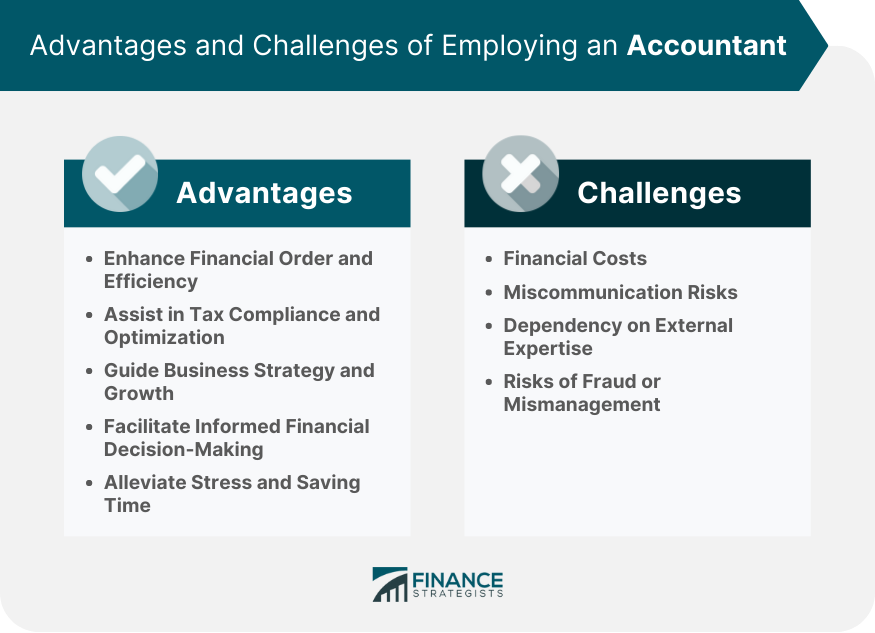

Once you have a handful of choices for a small company accounting professional, bring them in for quick interviews. https://www.gps-sport.net/users/pvmaccount1ng. Company proprietors have several various other responsibilities geared in the direction of development and development and do not have the moment to handle their finances. If you own a local business, you are most likely to manage public or private accountants, who can be hired for an in-house service or outsourced from an accountancy firmAs you can see, accountants can help you out during every stage of your company's growth. That does not suggest you need to work with one, but the best accountant ought to make life simpler for you, so you can concentrate on what you love doing. A CPA can aid in taxes while additionally providing customers with non-tax solutions such as bookkeeping and monetary encouraging.

The Ultimate Guide To Pvm Accounting

One more major negative aspect to accounting professionals is their inclination for mistake. Working with an accountant lowers the probability of filing unreliable documents, it does not entirely eliminate the opportunity of human error influencing the tax return. An individual accountant can aid you prepare your retired life and also withdrawl. They can help you handle your sequence of returns take the chance of to ensure that you do not run out of cash.

This will certainly help you develop a company strategy that's sensible, professional and more probable to do well. An accountant is a specialist who looks after the financial health and wellness of your service, day in and day out. Every little service proprietor should consider employing an accountant before they in fact need one. Additionally, individual accounting professionals enable their customers to conserve time.

The Only Guide for Pvm Accounting

They'll additionally likely come with an important specialist network, as well as wisdom from the successes and failings of businesses like yours. Employing a Certified Public Accountant that recognizes https://turbo-tax.org/why-you-should-hire-an-accountant-for-your/ fixed possession audit can properly value your genuine estate while remaining on top of factors that affect the numbers as time goes on.

Your accounting professional will certainly also give you a sense of needed start-up prices and financial investments and can reveal you just how to keep working also in durations of decreased or unfavorable money circulation. - https://seedandspark.com/fund/pvmaccount1ng?token=8f6b4b1bcf924a5a1017d32aabe39ac5042177ac24a9d88ca7b878eeb6bda9eb

Pvm Accounting for Beginners

Declaring tax obligations and managing finances can be especially challenging for tiny business owners, as it calls for knowledge of tax obligation codes and monetary guidelines. A Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) can give invaluable support to small business proprietors and aid them browse the intricate globe of financing.

: When it pertains to accounting, audit, and monetary preparation, a certified public accountant has the expertise and experience to assist you make informed choices. This competence can save tiny company owners both money and time, as they can rely on the CPA's knowledge to ensure they are making the most effective economic selections for their service.

4 Simple Techniques For Pvm Accounting

Certified public accountants are trained to remain up-to-date with tax obligation legislations and can prepare exact and timely tax obligation returns. This can save small company owners from frustrations down the line and ensure they do not encounter any fines or fines.: A CPA can likewise help small company proprietors with economic planning, which entails budgeting and forecasting for future development.

: A CPA can additionally provide useful understanding and analysis for tiny service proprietors. They can help determine areas where business is flourishing and areas that need enhancement. Equipped with this page details, small company proprietors can make changes to their procedures to optimize their profits.: Finally, hiring a CPA can supply local business proprietors with tranquility of mind.

Everything about Pvm Accounting

Doing taxes is every obedient resident's responsibility. Besides, the government won't have the funds to offer the services we all trust without our taxes. Consequently, everyone is encouraged to arrange their tax obligations prior to the due day to ensure they avoid penalties. It's also advised due to the fact that you obtain advantages, such as returns.

The dimension of your income tax return depends on several aspects, including your income, reductions, and credit ratings. Because of this, hiring an accounting professional is suggested due to the fact that they can see whatever to ensure you get the maximum quantity of money. In spite of this, lots of people refuse to do so because they think it's absolutely nothing greater than an unnecessary expenditure.

The 9-Second Trick For Pvm Accounting

When you hire an accountant, they can aid you avoid these errors and guarantee you get the most refund from your tax obligation return. They have the knowledge and expertise to understand what you're qualified for and just how to get the most cash back - Clean-up accounting. Tax obligation season is commonly a demanding time for any taxpayer, and for a great factor

Comments on “Examine This Report on Pvm Accounting”